Some Known Questions About What Is Trade Credit Insurance.

Wiki Article

The smart Trick of What Is Trade Credit Insurance That Nobody is Discussing

Table of ContentsExamine This Report about What Is Trade Credit InsuranceThe smart Trick of What Is Trade Credit Insurance That Nobody is Talking AboutThe 7-Minute Rule for What Is Trade Credit Insurance

Then, during the year, if any one of those customers go breast or don't pay, then we will certainly make the settlement. We look at the entire turnover of a company and we finance the totality. "What we're translucenting digital systems is that people can go online and can market a solitary invoice.

The systems can see the billings that are exceptional as well as can make an offer to acquire those outstanding invoices. What the client can then do is take the choice to insure that solitary billing. As soon as that billing is insured, it's generally a warranty that the billing will certainly be paid - What is trade credit insurance. "At Euler Hermes, we believe there's going to be a change in the method profession credit rating insurance policy is distributed.

Not known Details About What Is Trade Credit Insurance

Required a broker? See our overview to finding the right broker.

For instance, a manufacturer with a margin of 4% that experiences a non-payment of 50,000 would certainly need 25 equal sales to make up for a single circumstances of non-payment. Credit scores insurance policy reduces versus this loss. You can reduce costs on credit rating details as that's covered, and you won't require to he has a good point squander sources on chasing collections.

You may be able to bargain favourable terms with your vendors as a credit history insurance coverage policy minimizes the effect of an uncollectable loan on them and potentially the entire supply chain. Credit scores insurance is there to aid you avoid and also alleviate your trading dangers, so you can create your service with the expertise that your accounts are safeguarded.

A business wanted to broaden sales with its existing clients yet was not totally comfy using them higher credit line. They spoke to Coface credit history insurance to cover the greater credit line so they could increase the amount of credit rating provided to customers without risk - What is trade credit insurance. This allowed them grow revenues and provide even more profits.

Rumored Buzz on What Is Trade Credit Insurance

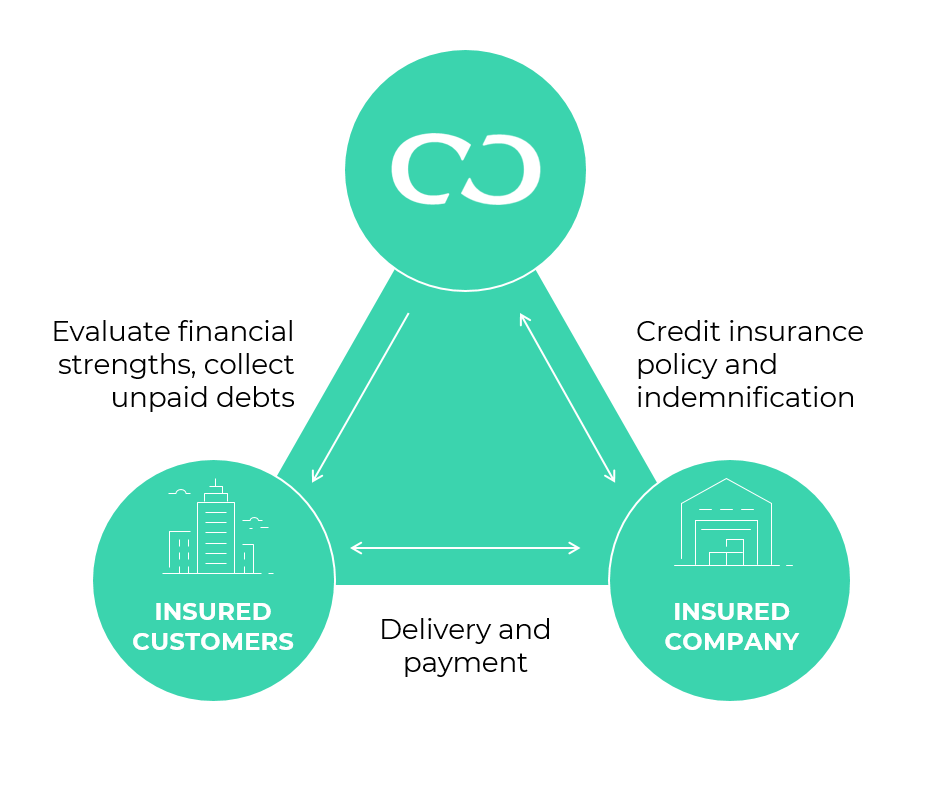

"From the initial purpose of offering convenience to our financial institutions, the service added deepness to our organization decisions." The communication enabled the firm to assess its customers' problem much more accurately and also has actually been an important tool in organization advancement.Australian organizations owe around $950 billion to various other companies. Which implies it's important to have defenses in position to make sure that in the event a financial institution does not satisfy its obligations, the business can still recoup its money. Obtaining trade credit score insurance policy is one way you can do this. Profession credit report insurance policy provides cover when a client try this web-site either comes to be financially troubled or does not pay its debts after a navigate here specific period (which is set out in the insurance coverage).

"In case a debt is unpaid, the plan owner might be able to assert approximately 90 per cent of the quantity of that financial debt, taking into account any excesses that might matter," he includes. When it concerns collecting the debt, typically the insurance firm will have its very own financial debt debt collection agency and also will seek the debt on part of business.

Report this wiki page